If you’ve followed this blog for very long, you know that we’re big fans of the DAF Research Collaborative (DRC), an academic team researching donor advised funds and sponsors.

The Collaborative has strong relationships with the DAF sponsor community, and they are granted in-depth access to information that is generally unavailable. Fortunately, they aggregate it, slice and dice it, and report on it for all of us.

Their latest report, The National Survey of Donor Advised Fund Managers (2025) is one that we have eagerly been awaiting. Unlike previous reports from the DRC which have focused on how much funds are growing and giving, this report focuses specifically on how sponsors (like Fidelity Charitable and Silicon Valley Community Foundation) manage the business of managing donor advised funds.

It might sound a little dry, but how sponsors manage their everyday operations actually impacts the nonprofit sector in ways we may not imagine. And in some ways, they’re very similar to the nonprofits they provide funding to.

Sponsor Back-Office Infrastructure

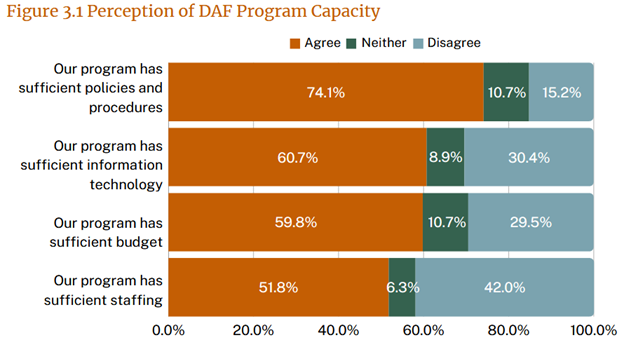

What we learn in this report is that sponsors – which are nonprofits, too – are fairly confident that they have sufficient policies and procedures in place to provide services to their fundholders and facilitate grant-making, but nearly a third feel that their information technology isn’t up to the task and nearly half feel that they don’t have enough staff. That tracks with what nonprofits everywhere are dealing with – tech that can’t keep up and not enough people to do the work.

So if you work for a nonprofit and you’re having trouble connecting with a sponsor to get answers to questions, it may just be that a little patience and work to build a relationship with a program officer will be your best bet – especially if the sponsor is relatively new. Sponsors that had operated DAF programs for 20+ years reported much more financial and staff stability than those that had been in operation for 15 years or fewer.

How Effective Are Sponsors at Doing What They Do?

One of the most interesting areas of the report was the section about DAF program effectiveness. While the majority of sponsors felt that they were very strong on back-office areas such as gift processing (recording gifts from the donor), grant management (making grants happen from funds to nonprofits), and investment management (growing the assets of the funds), they indicated that they were significantly weaker on philanthropic advising (suggesting nonprofits for fund advisors to give to) and soliciting DAF contributions (asking donors to set up new funds or add to existing funds).

Only a third of sponsors said that they were very effective at soliciting DAF contributions. As we all know, fundraising is hard work.

Also, only about half said that they were good at philanthropic advising. That’s a huge opportunity for nonprofits. If a sponsor doesn’t know that your nonprofit exists or the services you provide, they’re not going to recommend it when a donor asks for recommendations. So: if your nonprofit provides key services within a specific geographic region, it makes sense to form relationships especially with community foundations operating in your region so they know exactly how your services impact the area.

What About Inactive Accounts? Do Sponsors Nudge Advisors to Make Gifts?

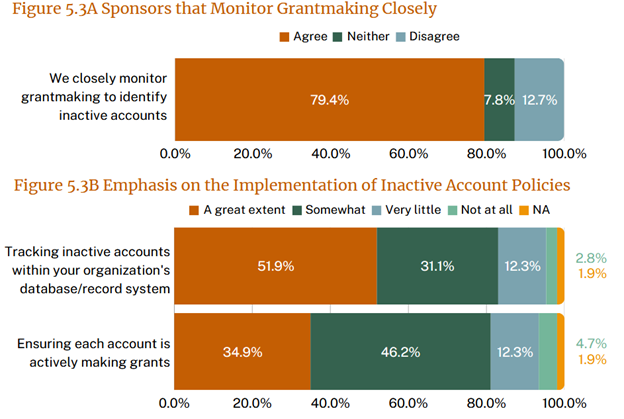

Nearly 80% of sponsors reported that they closely monitor grantmaking to identify inactive accounts. However, only about a third actually do anything about it, according to the report.

Why? It seems to tie back to their database and their IT capabilities. The sponsors that had sufficient budgets and staffing were more likely to report that they implemented inactive account policies and procedures than smaller or less-resourced sponsors. And when they did, nearly 70% said that those policies reactivated grantmaking.

What about inactive accounts?

One question we get asked a lot is about inactive funds. Many fundraisers worry that people set up DAF accounts and then just let the money sit there, doing nothing. So what’s the story there?

According to the study, 82% of the sponsors they surveyed said that they make multiple attempts to nudge donor/advisors into making grants. The amount of times they contact donors varies, but if there is no response sponsors will close accounts due to inactivity and move the remaining funds into the sponsor’s general fund. Only 18% of sponsors never contact donors to encourage them to give.

The big question: what about anonymous giving?

The lingering conjecture in our field is that people set up DAFs in order to make anonymous gifts, and that notion is fueled by long-standing frustration on the part of nonprofits that receive limited information when a DAF check arrives.

The frustration is real, and its reality is tied to how the sponsor’s forms are created.

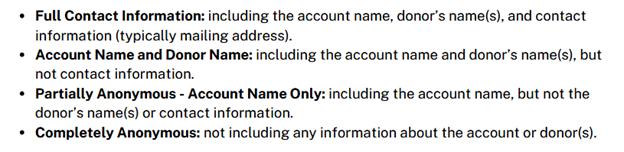

When a donor/advisor makes a grant via the sponsor’s online system, as you’d expect, they have to fill in a form. The way that the form was initially created – and its default settings – impacts how the gift is reported to the nonprofit.

From the report:

“On their online platform for recommending grants, sponsors present one of these options as the default for acknowledgement. The default option is often selected the most when filling out forms…When asked what their default option was for donor acknowledgement on their online platform, 36% included full contact information. This is notable, as full information maximizes the likelihood that a nonprofit grantee will accurately match a grant to existing donor records and promptly steward and thank them for their donation.”

So only a little over a third of the time are nonprofits receiving enough information to properly thank donors — based on a default setting. No wonder there’s so much frustration! It’s a huge opportunity for nonprofits to encourage sponsors to change those defaults and eliminate donor frustration that they’re not being thanked.

Speaking of being thanked, we at DAFinitive® would like to extend heart-felt thanks to the DAF Research Collaborative and specifically Dr. Daniel Heist and Dr. Danielle Vance-McMullen for pioneering and continuing this important work studying donor advised funds.

There are well over 1,000 sponsors in the US marketplace now administering over 2 million donor advised funds; this is an exciting (and exploding) area of philanthropy not just in the United States but world-wide. It deserves to be academically studied, understood, and even scrutinized just as other areas of our sector are, so that we continue to find new, meaningful, and ethical ways of supporting transformational change for good in our world. We look forward to their next report, and sharing more key highlights with you.